When you face the probate process, one of the most common questions is “Who pays probate attorney fees”? As a settler, executor, or beneficiary, understanding who is responsible for these costs can make a huge difference in how you navigate the probate process. While managing an estate or if you are unsure about your financial obligations, the true aspects of probate fees can clear the doubtful situations during your tough probate time.

Fales Law Group guides you through every step of the probate process with expert advice and personalized attention. Our dedicated legal professionals prioritize clarity and compliance in every single matter. Schedule a free consultation today!

In this article, we’ll explain what probate attorney fees are, who pays for probate attorney fees, and offer insights that could save you time, money, and headaches.

What Are Probate Attorney Fees

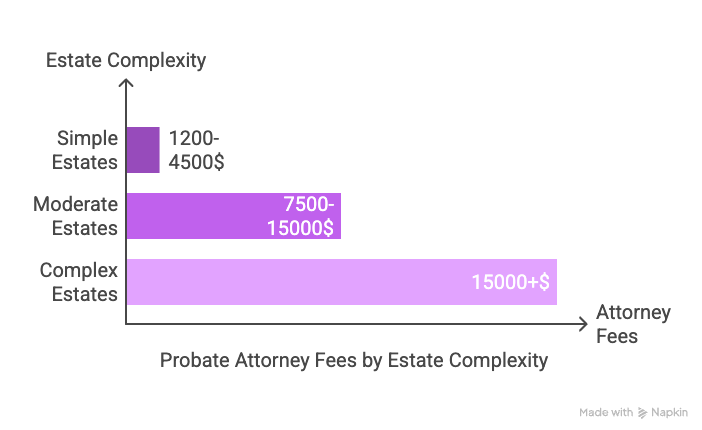

Probate attorney fees can vary widely depending on the location, the complexity of the estate, and the attorney’s experience. Here’s a breakdown of the typical costs:

- Simple Estates: Total attorney fees might be around $1,200 to $4,500, depending on the state and complexity.

- Moderate Estates: Fees can range from $7,500 to $15,000.

- Complex or Disputed Estates: Costs can exceed $15,000, especially if there are disputes among heirs or complex assets involved.

Additional Costs

- Court Filing Fees: These can range from $50 to $1,200, depending on the jurisdiction and estate size.

- Other Expenses: Appraisal fees, accounting fees, and costs for other professional services may also apply

4 Facts about Who Pays Probate Attorney Fees

In most cases, probate attorney fees are paid from the estate’s assets before they are distributed to beneficiaries. This is the standard practice because the estate is considered the “client” receiving legal services during the probate process. The executor or personal representative of the estate is responsible for managing these payments, ensuring that attorney fees and other administrative costs are settled as part of the estate’s obligations.

Here are 4 facts about probate attorney fees and who pays them:

1. Probate Attorney Fees Are Often Paid from the Estate

In most cases, the estate pays probate attorney fees, not the executor. So, as an executor, you usually don’t have to worry about paying the attorney directly from your own funds. Instead, these fees are deducted from the assets of the deceased’s estate itself.

If the probate attorney charges $10k for their services, that fee is typically deducted from the estate’s funds before the remaining balance is distributed to the beneficiaries. When the estate covers its own costs, you don’t have to use personal savings to pay the fees upfront.

The average cost of probate attorney fees in the U.S. is about 2% to 5% of the estate’s total value. Therefore, the fees depend on the complexity of the estate and the attorney’s billing structure.

2. The Executor May Be Responsible for Attorney Fees If the Estate Is Insolvent

What happens if the estate doesn’t have enough assets to cover the attorney’s fees? That’s where things get tricky. In cases where the estate is insolvent, it doesn’t have enough assets to cover its debts.

So, the executor can be personally responsible for covering the probate attorney’s fees if the estate can’t pay. This is why executors must assess the estate’s solvency before accepting the role.

3. Some States Have Laws Governing Who Pays the Fees Based on the Will

Did you know that the state laws where the probate takes place can influence who pays the attorney fees? While most states allow the estate to pay, some require that specific instructions be included in the will. In California, the will may specify that a particular beneficiary or group of beneficiaries should cover the attorney fees.

However, in other states, the default is to charge these fees to the estate itself unless the will clearly states otherwise. This highlights the importance of working with a skilled probate attorney who understands local laws and can ensure your will’s instructions are clearly written to avoid confusion.

4. Who Pays the Attorney Fees Can Get Complicated in a Contested Will

Things can get messy when family members contest a will. If someone challenges the will’s validity, it can drag the probate process into court and add extra layers of legal fees. In these cases, the question of who pays probate attorney fees can get complicated.

If a family member contests the will, the case goes to trial. If the court rules that the will is valid, the challenger might have to pay their own attorney fees. However, if the challenge is deemed frivolous, the losing party could be forced to cover both sides’ legal expenses.

The contested will situation often leads to higher attorney fees that could be split among the parties involved, depending on the court’s ruling.

Mastering Probate Attorney Fees with Ease

You can navigate the probate process smoothly by understanding who pays probate attorney fees in different situations. Executors for managing an estate and beneficiaries trying to understand your financial responsibilities can make the process and cost management seamless with this understanding.

When settlers know the financial outcomes of their probate decisions, they can plan wisely. These facts help you prepare for the costs involved in your particular needs. However, with the right legal guidance, you can take control of the probate process and make informed decisions about attorney fees and more.

Fales Law Group provides professional advice on cost-effectively navigating the probate process. Contact us today for personalized assistance and care!